Navigate to SAP Menu → Logistics → Sales and Distribution → Sales → Order → VA01 - Create

Debit memo code#

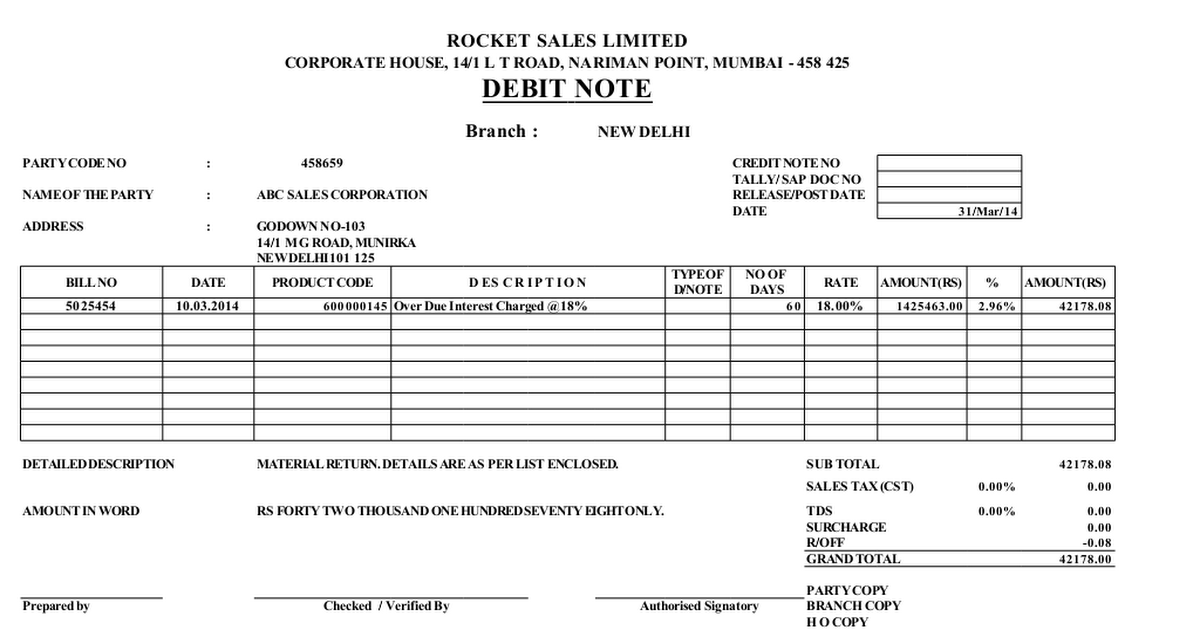

Step-1: Enter the transaction code VA01 in the SAP command field and click Enter to continue. The request for a debit memo can then be approved or rejected.īelow process is to create a debit memo request for the sales order 13930. Debit memo is like a standard order and the system uses the debit memo request to create a debit memo. The debit memo request can be blocked from being billed or to verify/review and once it is approved, the block can be removed. If the prices calculated for the customer were too low, debit memo request can be created. Debit memo request is a sales document used in complaints processing for a customer. Merchants can simply issue a debit memo for the over-payment and remove the positive balance or issue a refund instead when the amount is material.Debit memo is a transaction that reduces Amounts Payable to a vendor. This debit memo issuance can be done within a firm.Īnother example is when customers make small over-payments on their purchase. To offset this balance, an accounting staff can issue a debit memo. Offsets are made when the amount is almost negligible and is very small.Īn example is when a customer has a very small amount left in his or her account. To correct this error, Company A will issue a debit memo to Company B with an explanation of the reason for the balance amount being charged. Upon checking, Company A found out that they made an error in the amount charged to Company B resulting in an underbilling of $25. It is an adjustment made in order to reflect the correct amount of the charge.įor example, suppose Company A charged Company B for an amount of $75. The purpose of debit memos for business to business transactions is to rectify a billing error issued by one party to the other. $3,000 starting balance – $40 bank fee = $2,960 remaining balance Incremental Billing

The fee is issued as a debit memo and the balance of the customer will then be $2,960.

When customers receive their bank account statements at the end of each month, they will be able to see the debit memo charged with a negative sign after the amount.įor example, a bank customer has a balance in his or her account for $3,000 and has made a request for additional printing of checks for which it was charged $40. Transactions that give rise to debit memos when it comes to retail banking are bank service fee, checkbook printing, charges due to insufficient funds of a check or checks issued. Three instances of why a Debit Memo may be issued are: for bank transactions (refers to bank related fees such as bank charges and other bank related fees), incremental billing (when sellers have charged the customer for lower than the actual price) or for offsets by the bank internally (for offsetting credit balances). Transactions such as bank fees, correction of invoices underbilled by sellers, or a correction of the balance in the person’s bank account are just some of the examples of why a debit memo is done. A person’s bank statement usually has three columns on the right side that represents credit, debit and balance.Ī credit is money that is deposited into the account, debit is money that is taken out from the account and the balance will show how much money is left in the account.Ī Debit Memorandum or simply called Debit Memo is a type of adjustment in a person’s bank account that typically represents transactions other than the normal debits that occur.

0 kommentar(er)

0 kommentar(er)